Grupa Żabka po pierwszym półroczu 2025 r: dobre wyniki finansowe, wzrost udziałów rynkowych i przyspieszenie tempa ekspansji

Grupa Żabka po pierwszym półroczu 2025 r: dobre wyniki finansowe, wzrost udziałów rynkowych i przyspieszenie tempa ekspansji

Znaczące zwiększenie skali działalności, wzrost rentowności oraz konsekwentna redukcja zadłużenia.

Grupa Żabka kontynuuje dynamiczny rozwój. Na koniec czerwca 2025 r. sieć liczyła już 11 793 sklepy, co oznacza wzrost o niemal 11% r/r. Grupa planuje przyspieszyć ekspansję i w roku 2025 uruchomić ponad 1 300 nowych placówek w Polsce i w Rumunii, wobec wcześniejszych planów zakładających 1 100 otwarć.

Pomimo wysokiej bazy z drugiego kwartału poprzedniego roku oraz niekorzystnych warunków pogodowych w maju, sprzedaż porównywalna (LfL) wzrosła w pierwszym półroczu 2025 r. o 6,1%. Rozwój kanałów cyfrowych oraz dalsze umacnianie pozycji w Rumunii wspierały wzrost sprzedaży. W efekcie skonsolidowana sprzedaż do klienta końcowego wyniosła 14,8 mld zł, rosnąc rok do roku o 14,4%, a przychody ze sprzedaży: 12,8 mld zł (+14,7%).

Rozbudowa sieci, poprawa LfL oraz dyscyplina kosztowa, przyczyniły się do wzrostu skorygowanego wyniku EBITDA o 18,2%, do 1 654 mln zł na koniec pierwszego półrocza 2025 r. Marża skorygowanego wyniku EBITDA wzrosła o 0,4 p.p., osiągając poziom 11,2%.

Zgodnie z sezonowym trendem, drugi kwartał przyniósł silne przepływy gotówkowe. W efekcie wskaźnik finansowego długu netto do skorygowanego wyniku EBITDA obniżył się o 0,5x rdr, osiągając na koniec pierwszego półrocza poziom 1,2x.

Tomasz Suchański, CEO Grupy Żabka, komentuje:

Osiągnięte dobre wyniki finansowe za pierwsze półrocze 2025 potwierdzają skuteczność zaprezentowanej inwestorom strategii rozwoju, opartej na nowoczesnym ekosystemie modern convenience. Systematycznie zwiększamy skalę działalności, zarówno poprzez rozwój sieci sklepów, jak i rozbudowę oferty cyfrowej, notując wzrost sprzedaży porównywalnej (LfL) oraz całkowitej sprzedaży do klienta końcowego. Przyspieszamy ekspansję - w ciągu sześciu miesięcy otworzyliśmy ponad 800 nowych placówek, co przybliża nas do realizacji nowego celu: ponad 1300 otwarć w całym 2025 r. Dynamiczny rozwój obserwujemy również na rynku rumuńskim, gdzie sieć Froo uruchomiła ponad 100 sklepów zaledwie rok po debiucie. W najbliższym czasie będziemy koncentrować się na zwiększaniu efektywności oraz realizacji strategicznego celu, jakim jest podwojenie wartości sprzedaży do klienta końcowego w latach 2023–2028.

Tomasz Blicharski, Group Chief Strategy & Development Officer, dodaje:

Pierwsze półrocze 2025 oraz II kwartał to dobry okres dla naszej firmy, w którym według danych Nielsena, rozwijaliśmy się ponad dwukrotnie szybciej niż rynek, zwiększając swój udział do 10,6% z 9,9% rok wcześniej. W czerwcu 2025 r. zakończyliśmy strategiczny projekt montażu pieców gastronomicznych we wszystkich sklepach, dzięki czemu możemy rozwijać menu posiłków na ciepło “Prosto z pieca” w skali całej Polski. Przyczyniło się to do dwucyfrowego wzrostu sprzedaży dań gotowych (QMS), co znacząco wsparło wzrost sprzedaży LfL w pierwszym półroczu o 6,1%. Systematycznie inwestujemy w rozwój oferty produktowej, która odpowiada na potrzeby naszych klientów. Rozszerzyliśmy ofertę śniadaniową o posiłki na ciepło jak np. tosty z szynką czy panini z jajecznicą - i tylko w pierwszym miesiącu od ich wprowadzenia, sprzedaliśmy milion produktów z tej kategorii. W obszarze cyfrowym rozwijamy ofertę Żabka Ads, dzięki czemu klienci mogą łatwiej poznawać nasze promocje i z nich korzystać. Równocześnie znacząco powiększyliśmy asortyment produktów dostępnych do szybkiego zakupu i dostawy online - teraz można zamówić już ponad 10 tysięcy różnych produktów przez naszą nową platformę delio+. W całym 2025 roku spodziewamy się solidnego wzrostu sprzedaży LfL (w przedziale od średnich do wysokich jednocyfrowych wartości procentowych), który będzie wspierany innowacjami oraz rozwojem rozwiązań cyfrowych, co pozwoli nam dalej umacniać pozycję lidera w branży.

Marta Wrochna-Łastowska, CFO Grupy Żabka, powiedziała:

Rosnąca sprzedaż, przekładająca się na pozytywne efekty skali, korzystnie wpłynęła na zyskowność bezpośrednią. W połączeniu z dyscypliną kosztową przełożyło się to w II kwartale 2025r. na 20% wzrostu skorygowanego wyniku EBITDA oraz poprawę marży skorygowanego wyniku EBITDA

o 0,6 p.p. do poziomu 13%. Wolne przepływy pieniężne wzrosły o 15% dzięki skutecznej kontroli wydatków i efektywności kosztowej. Zgodnie z sezonowym trendem, drugi kwartał przyniósł silne przepływy gotówkowe. W efekcie, wskaźnik finansowego długu netto do skorygowanego wyniku EBITDA obniżył się o 0,5x rdr, osiągając na koniec pierwszego półrocza poziom 1,2x. Wypracowane wyniki stanowią solidną podstawę do utrzymania marży skorygowanego wyniku EBITDA na poziomie 12–13% na koniec 2025 r. oraz dalszej poprawy rentowności skorygowanego zysku netto do około 3% w krótkim okresie.

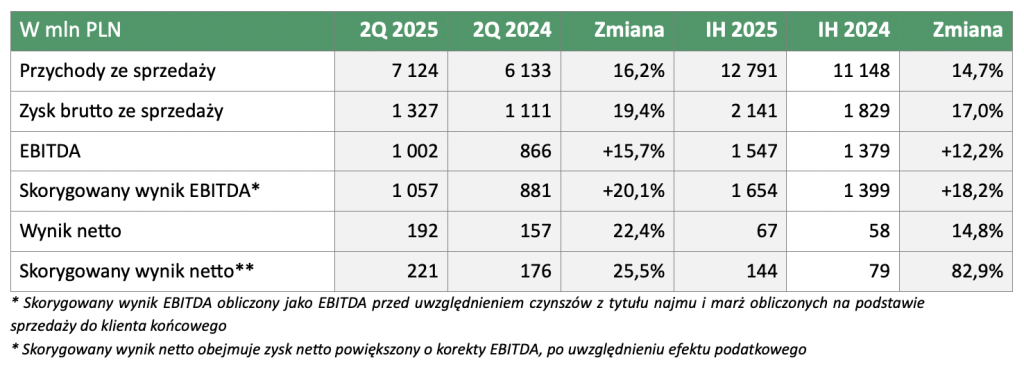

Kluczowe informacje nt. wyników Grupy Żabka po 1H 2025 roku:

- Przychody ze sprzedaży w I półroczu 2025 r. wzrosły o 14,7%, do poziomu 12,8 mld zł. W samym drugim kwartale przychody wzrosły o 16,2%, do poziomu 7,1 mld zł. Ten rezultat to efekt solidnego wzrostu organicznego, napędzanego mocną sprzedażą LfL oraz rozbudową sieci sklepów i kanałów cyfrowych.

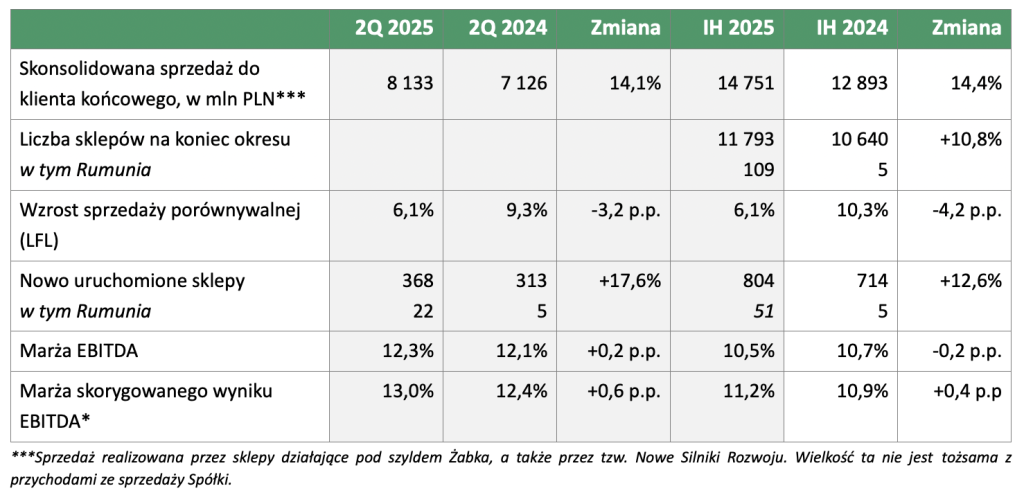

- Sprzedaż do klienta końcowego w okresie 6 miesięcy tego roku sięgnęła 14,8 mld zł, czyli o 14,4% więcej niż przed rokiem. W drugim kwartale sprzedaż wzrosła o 14%, do 8,1 mld zł.

- Sprzedaż LfL wzrosła o 6,1% zarówno w pierwszym półroczu, jak i w drugim kwartale, pomimo wysokiej bazy z drugiego kwartału 2024 r. oraz nietypowo chłodnej pogody w maju. Wzrost ten wynikał w dużej mierze z innowacji w obszarze komercyjnym oraz rozwoju nowej oferty produktowej, zwłaszcza w segmencie dań gotowych (QMS).

- Poprawa marży bezpośredniej oraz utrzymywanie dyscypliny kosztowej pozwoliły zwiększyć skorygowaną EBITDA w drugim kwartale o 20,1% rok do roku, do poziomu 1 057 mln zł. W całym pierwszym półroczu wzrósł on o 18,2%, do 1 654 mln zł. Marża skorygowanego wyniku EBITDA wzrosła do 13% w drugim kwartale (wobec 12,4% rok wcześniej) oraz 11,2% w całym półroczu (wobec 10,9% rok wcześniej).

- Na koniec czerwca 2025 r. sieć Grupy Żabka – największa convenience w Europie – liczyła 11 793 placówki w Polsce i Rumunii, co oznacza wzrost o 10,8% względem 10 640 rok wcześniej. Tylko w drugim kwartale otworzono 368 nowych sklepów. Według założeń z IPO, potencjał rynku to blisko 19 500 sklepów w Polsce oraz około 4 000 w Rumunii, co wskazuje na duże możliwości dalszej ekspansji.

- Kanały cyfrowe (DCO) zanotowały w pierwszym półroczu 2025 r. wzrost sprzedaży do klienta końcowego o 26% (28% w II kwartale), co znacząco wpłynęło na wyniki Grupy i zbliżyło ją do realizacji celu z IPO zakładającego pięciokrotny wzrost przychodów DCO do 2028 r. Kluczowe inicjatywy to udoskonalenie Żabka Ads oraz rozszerzenie oferty q-commerce do ponad 10 tys. produktów na platformie delio+.

- Skorygowany zysk netto w pierwszej połowie 2025 r. wyniósł 144 mln zł, co oznacza wzrost o 82,9% w porównaniu do poprzedniego roku. W drugim kwartale było to 221 mln zł wobec 176 mln zł rok wcześniej (+25,5%).

- Wolne przepływy pieniężne w pierwszym półroczu sięgnęły 1 165 mln zł wobec 1,26 mld zł rok wcześniej. W drugim kwartale 2025 r. wzrosły o ponad 14%, do 1 074 mln zł, dzięki kontroli wydatków i efektywności kosztowej.

- Nakłady inwestycyjne (CAPEX) w pierwszym półroczu 2025 r. wyniosły 740 mln zł, co oznacza wzrost o 14,7% rok do roku. Inwestycje objęły rozbudowę sieci oraz modernizację placówek, w tym montaż pieców gastronomicznych, umożliwiających wprowadzenie nowej oferty dań typu street food.

- Zadłużenie Grupy Żabka systematycznie maleje. Na koniec drugiego kwartału 2025 r. wskaźnik finansowego długu netto do skorygowanego wyniku EBITDA spadł do poziomu 1,2x, o 0,5x w ciągu ostatnich miesięcy. Grupa planuje dalszą redukcję zadłużenia.

Podsumowanie wyników za IH 2025 i 2Q 2025

Wybrane KPI i mierniki efektywności

(wszystkie marże obliczone na podstawie sprzedaży do klienta końcowego)

Skup akcji własnych

Zgodnie z raportem bieżącym z dnia 31 lipca 2025, Rada Dyrektorów Grupy Żabka zatwierdziła program skupu akcji własnych w celu realizacji zobowiązań wynikających z długoterminowego planu motywacyjnego (LTIP) na lata 2025–2027, o którym Spółka informowała podczas IPO. Program ruszy w sierpniu i obejmie do 4,2 mln akcji.

Skup zostanie przeprowadzony na rynku regulowanym zgodnie z zasadami MAR, a jego realizację powierzono domowi maklerskiemu Trigon.

Celem programu LTIP jest wzmocnienie długoterminowego zaangażowania kluczowych pracowników poprzez powiązanie wynagrodzenia motywacyjnego z długoterminowym wzrostem wartości generowanym przez Spółkę, w tym wzrostem wyniku EBITDA i sprzedaży do klienta końcowego oraz poprawą wskaźników ESG.