Żabka Group after the first half of 2025: strong financial performance, increased market share, and accelerated expansion

Żabka Group after the first half of 2025: strong financial performance, increased market share, and accelerated expansion

Marked growth in scale, improved margins, and continued deleveraging

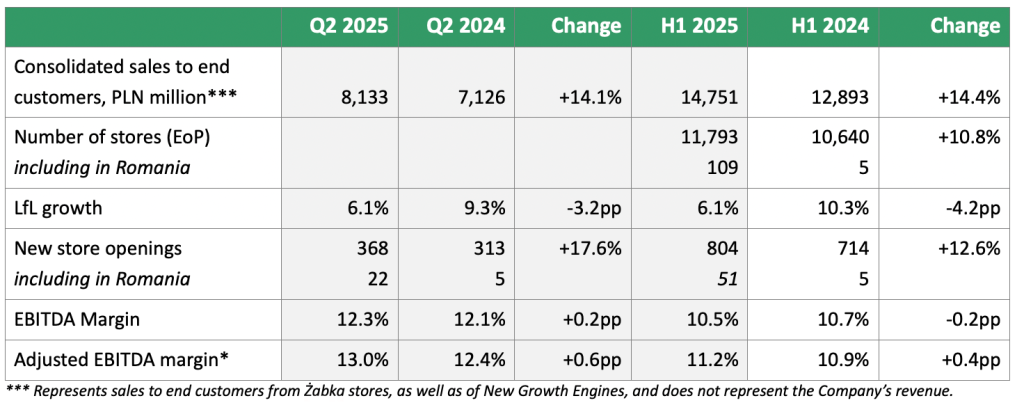

Żabka Group maintains its strong growth trajectory. As at 30 June 2025, our network comprised 11,793 stores, an increase of close to 11% YoY. We are now planning to step up expansion, with more than 1,300 new store openings targeted in Poland and Romania for full-year 2025, an upward revision from our original target of 1,100 openings.

Despite a high comparative base from Q2 2024 and unseasonably cold weather in May, like-for-like (LfL) sales rose by 6.1% during the first half of 2025. Continued expansion of our digital consumer offering (DCO), coupled with our stronger market position in Romania, further supported sales momentum. Consequently, consolidated sales to end customers reached PLN 14.8 billion, a year-on-year increase of 14.4%, while revenue totalled PLN 12.8 billion (up 14.7%).

Ongoing network expansion, solid LfL growth, and tight cost discipline led to an 18.2% increase in adjusted EBITDA, to PLN 1,654 million, for the six months ended 30 June 2025. As a result, the adjusted EBITDA margin widened by 0.4pp, to 11.2%.

Seasonally strong cash generation in the second quarter further strengthened our financial position, reducing the net financial debt-to-adjusted EBITDA ratio to 1.2x, an improvement of 0.5x YoY.

Tomasz Suchański, CEO of Żabka Group, commented:

“Our strong H1 2025 performance confirms that the growth strategy we presented to investors, which is built around an ultimate modern convenience ecosystem, is working. We are consistently scaling our business by adding new stores as well as expanding our digital consumer offering, both of which continue to contribute to LfL growth and total sales to end customers. We have accelerated our rollout programme, opening more than 800 outlets in the first six months of 2025 alone. This puts us firmly on track to meet our upgraded target of over 1,300 openings this year. The momentum in Romania is equally encouraging, with our Froo banner surpassing 100 stores barely a year after launch. In the near term, we will focus on achieving further efficiency gains while delivering on our strategic ambition to double sales to end customers between 2023 and 2028.”

Tomasz Blicharski, Group Chief Strategy & Development Officer, added:

“The first half of 2025, and the second quarter in particular, was another strong period for Żabka. Nielsen data show we grew more than twice as fast as the market, increasing our share to 10.6% from 9.9% a year ago. In June, we completed the roll-out of street food ovens across our entire store network, which enables us to expand our ‘Prosto z pieca’ hot-food offering nationwide. This upgrade spurred a double-digit percentage uplift in Quick Meal Solutions (QMS) sales and was a key driver of the 6.1% LfL growth achieved in H1 2025. We continue to invest in our product to anticipate and respond quickly to changing customer preferences. An expanded breakfast menu, now featuring hot items such as ham toasties and scrambled-egg paninis, achieved sales of one million units in its first month alone. In the digital world, we are making further enhancements to Żabka Ads, allowing customers to more easily discover and redeem promotions. Concurrently, we have significantly broadened our q-commerce offering: our new delio+ platform now lists more than 10,000 SKUs available for rapid delivery. For full-year 2025, we expect solid mid- to high-single-digit LfL growth, driven by ongoing innovation and continued DCO development, which will allow us to further strengthen our leadership in modern convenience.”

Marta Wrochna-Łastowska, CFO of Żabka Group, said:

“Robust sales growth, which generated clear economies of scale, had a positive impact on our gross margin performance. Combined with tight cost control, this translated into a 20% increase in adjusted EBITDA in the second quarter, with the adjusted EBITDA margin expanding by 0.6pp, to 13%. Free cash flow rose 15% on the back of disciplined capital allocation and ongoing cost efficiencies. Seasonally strong cash generation in the second quarter further strengthened our financial position, reducing the net financial debt-to-adjusted EBITDA ratio to 1.2x, down 0.5x YoY. These results provide a solid foundation to maintain our full-year adjusted EBITDA margin within the 12–13% range and to improve our adjusted net profit margin to around 3% in the near term.”

Żabka Group’s performance highlights as at 30 June 2025:

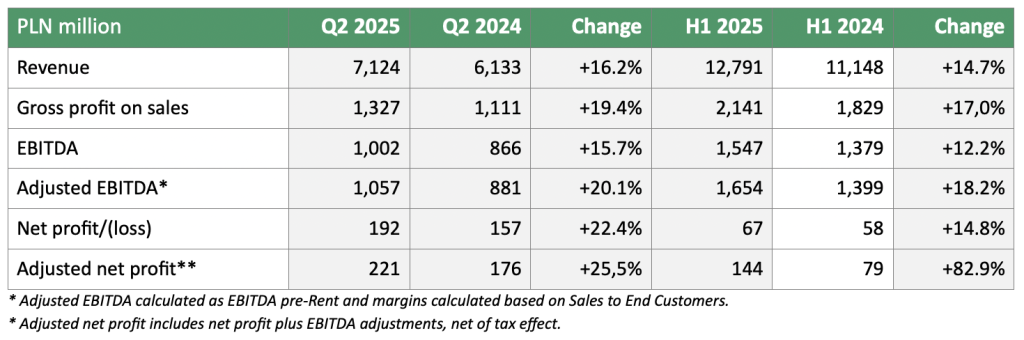

- Revenue for the first half of 2025 rose by 14.7%, to PLN 12.8 billion. In the second quarter alone, revenue increased by 16.2%, to PLN 7.1 billion. This result reflects solid organic growth, driven by strong LfL sales and the continued expansion of our store network and DCO.

- Sales to end customers reached PLN 14.8 billion, a year-on-year increase of 14.4%. In the second quarter, sales grew by 14%, to PLN 8.1 billion.

- Like-for-like sales rose by 6.1% in both H1 and Q2 2025, despite the strong comparative base from Q2 2024 and unseasonably cool weather in May. This increase was largely driven by commercial innovation and an expanded product range, particularly in the QMS segment.

- A stronger gross profit margin, combined with disciplined cost management, drove a 20.1% year-on-year growth in adjusted EBITDA in the second quarter, to PLN 1,057 million. For the full six months ended 30 June 2025, adjusted EBITDA grew by 18.2%, to PLN 1,654 million. The adjusted EBITDA margin improved to 13% for the second quarter alone (vs. 12.4% a year earlier) and to 11.2% for the first half of 2025 (vs. 10.9% in the prior year).

- As at 30 June 2025, the Żabka Group network – Europe’s largest convenience chain – comprised 11,793 outlets in Poland and Romania, an increase of 10.8% from 10,640 a year earlier. The second quarter alone saw 368 new store openings. According to the IPO guidance, total market capacity is estimated at nearly 19,500 stores in Poland and approximately 4,000 in Romania, which highlights substantial headroom for further expansion.

- DCO sales to end customers grew by 26% in the first half of 2025 (28% in Q2 alone), making a meaningful contribution to the Group’s overall performance and bringing us closer to the IPO target of a five-fold increase in DCO revenue by 2028. Key drivers included the refinement of Żabka Ads and the expansion of our q-commerce range, which now comprises more than 10,000 SKUs on our delio+ platform.

- Adjusted net profit for the first half of 2025 came in at PLN 144 million, an increase of 82.9% year on year. In the second quarter alone, the figure was PLN 221 million, up 25.5% from PLN 176 million a year earlier.

- Free cash flow totalled PLN 1,165 million in the six months to 30 June 2025, vs. PLN 1.26 billion in the corresponding period last year. In the second quarter, free cash flow rose by over 14%, to PLN 1,074 million, driven by disciplined spending and sustained cost efficiencies.

- Capital expenditure amounted to PLN 740 million in the first half of 2025, a year-on-year increase of 14.7%. Investments included network expansion and store upgrades, notably the roll-out of food-service ovens, which enabled the launch of our new street-food offering.

- Żabka Group continued to deleverage: as at 30 June 2025, the net financial debt-to-adjusted-EBITDA ratio stood at 1.2x, an improvement of 0.5x over recent months. The Group intends to reduce leverage further.

Key figures for H1 and Q2 2025

Selected KPIs and performance metrics

(all margins calculated in relation to Sales to End Customers)

Share buy-back

As per the current report dated 31 July 2025, the Zabka Group Board of Directors approved a share buy-back programme to meet the obligations arising under the 2025–2027 Long-Term Incentive Plan (LTIP), as communicated at the time of our IPO. The programme will commence in August and will cover up to 4.2 million shares.

The buy-back will be executed on the regulated market in accordance with the MAR requirements. The Trigon brokerage house has been appointed to manage the programme.

The LTIP is designed to strengthen the long-term commitment of key personnel by aligning incentives with long-term value creation, including EBITDA growth, sales to end customers, and ESG indicators.